Brands have more ways than ever to connect with customers, but deciding where to invest can be a challenge. Two of the most common mobile engagement tools, mobile wallet passes and branded apps, offer very different experiences, costs, and returns. Both have strengths, but they also come with trade-offs that can make or break your customer engagement strategy.

This post breaks down the differences across four critical areas: cost, engagement, user behavior, and long-term ROI. We’ll also look at how the right mix can create the strongest results.

Cost: Lean vs. Heavy Investment

Mobile Wallet Passes

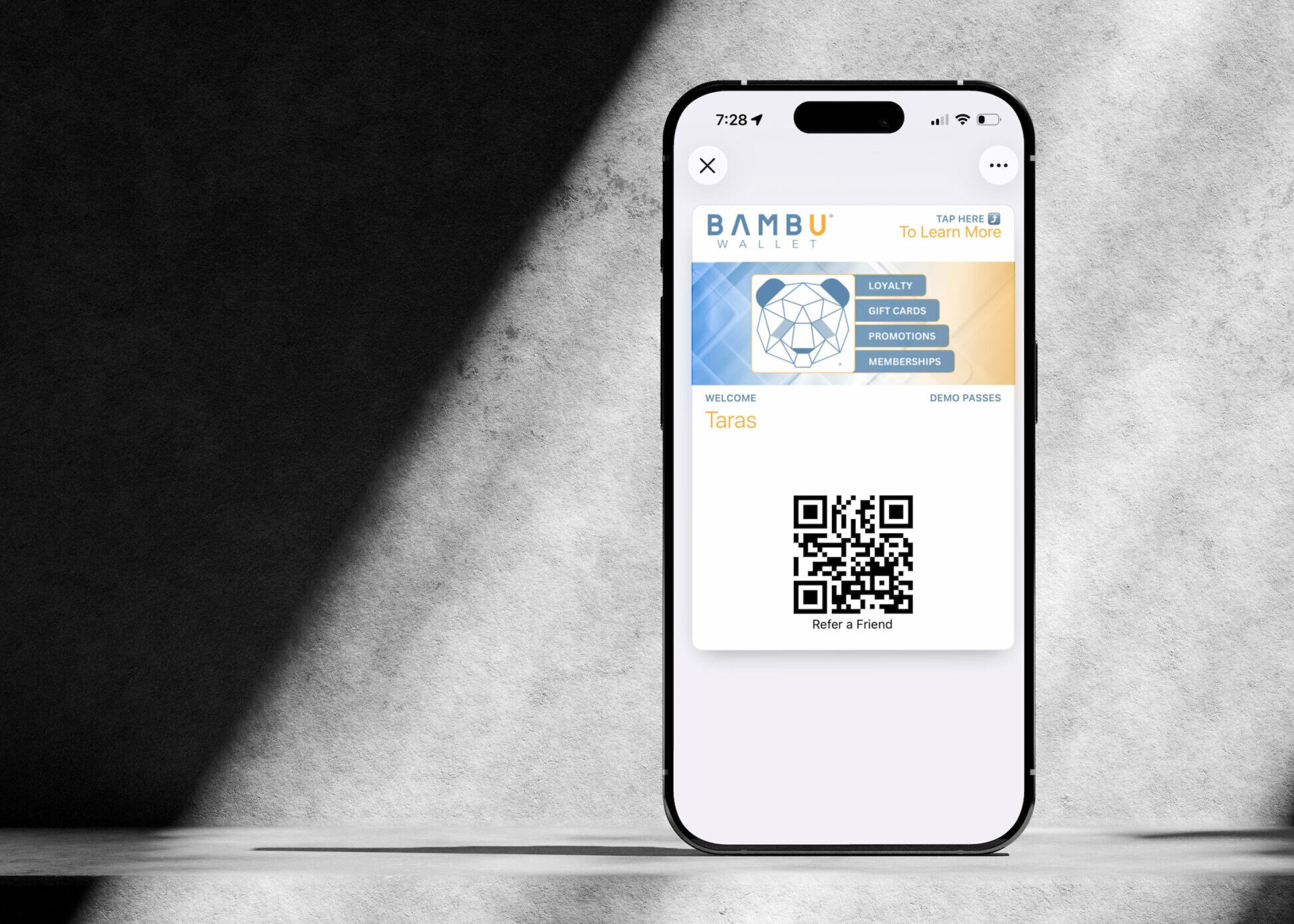

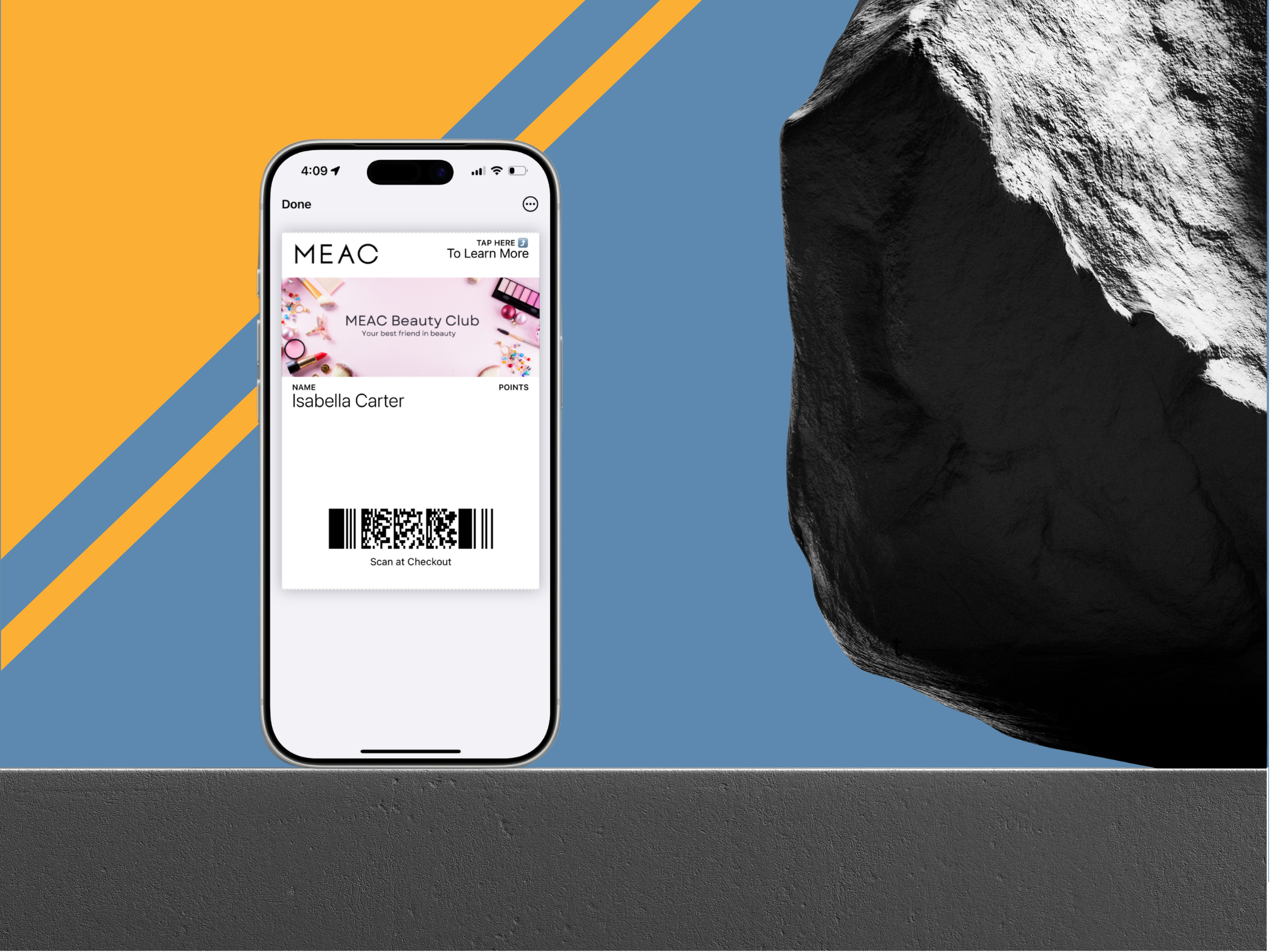

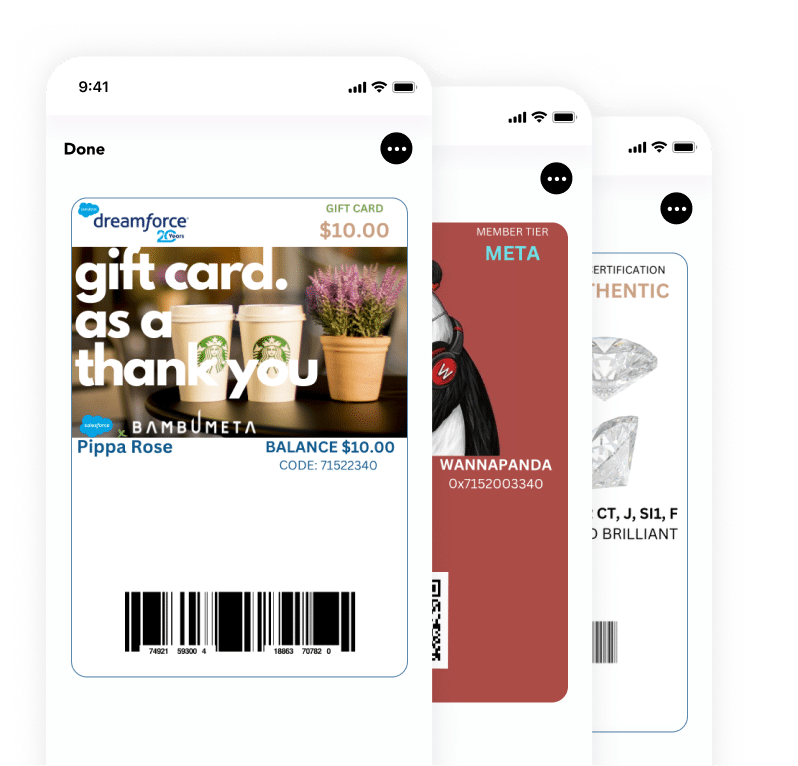

Wallet passes are highly cost-effective because they operate within Apple Wallet and Google Wallet, platforms already installed on most smartphones. Brands skip the expense of custom app development and ongoing updates. Instead, the focus is on creating the pass, connecting it to a back-end system for real-time updates, and designing a strategy for notifications and offers.

Ongoing costs are low. Updates push instantly, so there is no need for costly version releases. There is also no App Store approval process, which saves both time and money.

Branded Apps

Apps are far more expensive to build and maintain. Even a simple branded app can cost tens of thousands of dollars to develop, and more complex ones can easily run into six figures. Updates, bug fixes, and OS compatibility adjustments add to ongoing expenses.

Marketing a new app to drive downloads is another significant investment. With app fatigue at an all-time high, acquisition costs per user are rising, and brands often spend more promoting the app than they do maintaining it.

Winner for Cost: Mobile Wallet Passes.

Engagement: Direct Access vs. Fighting for Attention

Mobile Wallet Passes

Passes can deliver lock screen notifications, often the most valuable real estate on a smartphone, without competing for space in email inboxes or app push queues. Because they are tied to a specific purpose such as loyalty, membership, coupons, or tickets, customers tend to see them as functional rather than promotional, which reduces opt-outs.

Engagement stays high because passes live in a place users already check regularly. When a pass updates automatically with a new offer or event change, customers notice.

Branded Apps

Apps can create deep, immersive experiences, but that comes at a cost: user attention. Even with push notifications, many apps are ignored or deleted within 90 days. To keep engagement high, brands must continually release new content, features, or offers, which requires ongoing resources.

For brands with rich loyalty ecosystems, exclusive digital experiences, or gamification strategies, apps can keep top customers highly engaged. For broader audiences, maintaining active users is a constant battle.

Winner for Engagement: Mobile Wallet Passes for broad, sustained engagement; Apps for niche, high-value loyalty communities.

User Behavior: Adoption and Friction

Mobile Wallet Passes

Adding a wallet pass takes seconds. Customers scan a QR code, tap a link in an SMS, or click an email button, and the pass is instantly saved to their phone. No logins, no downloads, and no account creation are required.

This frictionless setup is a major advantage in driving adoption. It also works well in real-world scenarios like point-of-sale interactions, event check-ins, or geofenced promotions.

Branded Apps

Apps require customers to make a bigger commitment, such as downloading from the App Store or Google Play, creating an account, and enabling notifications. That is a lot of steps before the brand can deliver value.

This hurdle is worth it for customers who see clear ongoing value, like personalized dashboards, order tracking, or exclusive perks. For many brands, getting casual or first-time customers over the download barrier is difficult.

Winner for User Behavior: Mobile Wallet Passes.

Long-Term ROI: Scalability and Lifetime Value

Mobile Wallet Passes

Wallet passes scale efficiently. They reach a wide audience quickly and keep them engaged at low cost, making them ideal for high-volume, low-maintenance programs like promotions, mobile coupons, and membership cards.

Data from wallet interactions, such as redemptions, updates viewed, and location-triggered activity, can feed into broader marketing strategies, allowing brands to refine offers and target high-value customers.

Branded Apps

Apps offer a broader range of functionality and data collection. They can integrate with e-commerce systems, offer personalized shopping experiences, and serve as a central hub for multiple customer touchpoints.

When an app becomes part of a customer’s daily or weekly routine, lifetime value can be significant. However, the steep initial investment means the ROI depends heavily on consistent, high engagement from a critical mass of users.

Winner for ROI: Tie — Wallet Passes for broad reach at low cost; Apps for deep engagement with a smaller, high-value segment.

Side-by-Side Comparison

| Category | Mobile Wallet Passes | Branded Apps |

|---|---|---|

| Cost | Low upfront and ongoing costs; no app store fees or major updates required | High development, maintenance, and marketing costs |

| Engagement | Lock screen notifications; high visibility; functional and relevant updates | Rich, immersive experiences but requires constant new content to maintain interest |

| Adoption | Instant add via QR, SMS, or email; no downloads or logins needed | Multiple steps to download and set up; higher drop-off rate |

| Long-Term ROI | Scales easily for promotions, memberships, and coupons; strong reach | High potential for loyal power users; better suited for complex features |

| Best Use Case | Mass reach, promotions, and ongoing customer touchpoints | Deep loyalty programs, personalized services, and exclusive experiences |

The Case for a Hybrid Approach

For many brands, the smartest strategy in 2025 is not choosing one over the other but aligning both tools to their strengths.

- Use mobile wallet passes for mass reach, quick adoption, and high-visibility campaigns. They are perfect for promotions, coupons, memberships, and event access.

- Use apps for customers who have already shown strong loyalty or spend and who will benefit from a richer, more interactive brand experience.

A hybrid model allows brands to capture both casual customers and brand advocates, each with a tailored engagement channel. The wallet pass acts as an easy entry point, and the app becomes the destination for those who want more.

Why Mobile Wallet Passes Lead the Way

While apps have their place, the reality in 2025 is that most consumers prefer lightweight, instant-access solutions over another download. Mobile wallet passes align perfectly with this preference, offering speed, convenience, and ongoing engagement without the clutter.

For many brands, especially in retail, CPG, events, and quick service restaurants, mobile wallet passes deliver more value faster and at a fraction of the cost than a standalone app. They are not just an alternative to apps; they are often the smarter first step in mobile engagement.

Ready to see how mobile wallet passes can fit into your mobile strategy?

Book a demo with Bambu today and discover how to reach more customers, reduce friction, and drive measurable results.