Digital loyalty cards are quickly becoming the preferred way for brands to build repeat business without adding friction for customers or staff. As mobile behavior continues to shape how people interact with brands, traditional punch cards are starting to feel outdated. They are easy to lose, hard to track, and disconnected from how customers actually live day to day.

This shift has pushed many businesses to rethink loyalty altogether. Instead of relying on paper cards or forcing customers into brand specific apps, companies are moving loyalty directly into the mobile wallet. Digital loyalty cards and digital punch cards meet customers where they already are and remove the small but meaningful barriers that slow adoption.

Why traditional punch cards no longer fit modern behavior

Physical punch cards were designed for a different era. They assumed customers would remember to carry them and staff would remember to ask for them. That assumption no longer holds up.

In practice, traditional punch cards create friction on both sides of the counter. Customers forget them. Staff hesitate to slow the line. Rewards get missed, which weakens the program over time.

Common pain points show up quickly:

- Cards are lost or damaged

- Checkout slows down when staff need to explain the program

- There is no visibility into performance

- Offers cannot be updated once printed

- Branding fades as cards wear out

Digital punch cards remove these issues by living inside the mobile wallet. Once a customer saves a digital loyalty card, it stays with them. There is nothing to replace and nothing to remember.

How digital punch cards actually work day to day

A digital punch card mirrors the simplicity of a physical one, but without the limitations. Customers earn punches for visits, purchases, or actions. Progress updates automatically and rewards are applied instantly.

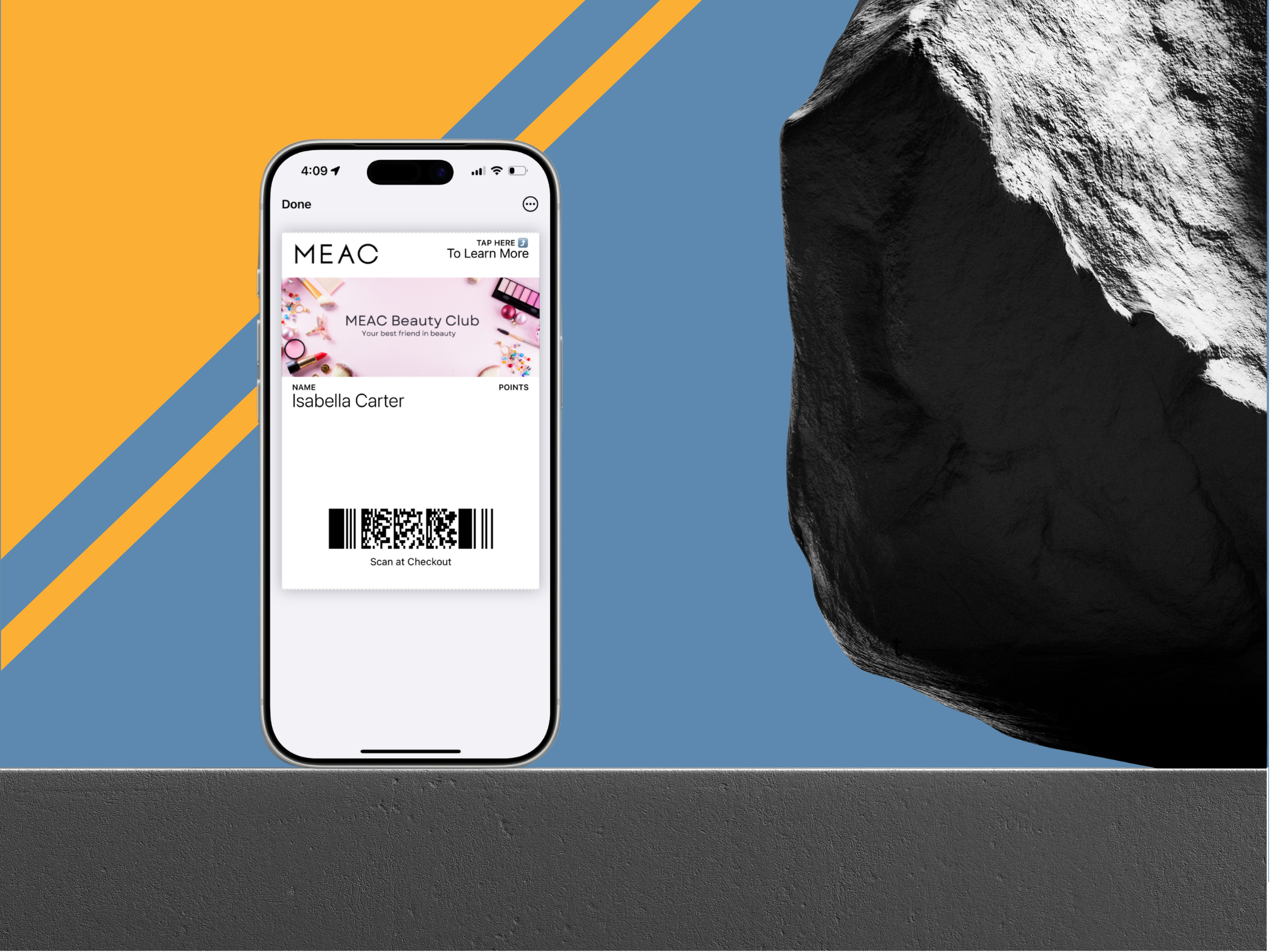

The key difference is where the card lives. Digital loyalty cards stored in Apple Wallet and Google Wallet are always accessible. Customers do not need to download an app or create an account. The card sits alongside payment methods and boarding passes, which makes it easy to find and easy to trust.

From the customer’s perspective, the experience feels almost invisible. From the brand’s perspective, it becomes far easier to manage.

Where digital loyalty cards create the biggest impact

At the heart of any loyalty program is a simple question. How much effort does it take to use?

Digital loyalty cards outperform traditional punch cards because they remove effort almost entirely. Physical cards rely on memory. Apps rely on motivation. Digital punch cards rely on neither. Once saved, they simply exist in the customer’s wallet.

This also changes what happens at checkout. Associates no longer need to ask about loyalty or explain how it works. Customers do not need to search through wallets or phones. The process becomes passive, which speeds up transactions and reduces small inefficiencies that add up across stores.

Visibility plays a major role as well. With traditional punch cards, customers only think about loyalty when they remember the card. With digital loyalty cards, progress is always visible. Seeing how close they are to a reward creates a natural reason to come back.

Why app based loyalty struggles

Many brands tried to solve loyalty through apps. In reality, app fatigue has become one of the biggest obstacles to engagement. Customers download apps with good intentions, then stop opening them. Notifications get turned off. Logins get forgotten.

Digital loyalty cards avoid this problem entirely. There is nothing to install and nothing to manage. Digital punch cards update automatically inside the mobile wallet, keeping loyalty present without demanding attention.

That simplicity is often what makes the difference between a program that looks good on paper and one that actually gets used.

Operational benefits brands notice first

Behind the scenes, digital loyalty cards simplify operations in ways that physical programs cannot. Paper based systems require reprints, replacements, and constant explanations. Digital punch cards are centrally managed and flexible.

Brands can:

- Update rewards without reissuing cards

- Extend or pause offers instantly

- Maintain consistent branding across locations

- Reduce staff training time

There is also a misconception that digital punch cards need to be complex to be effective. In practice, the strongest programs are usually simple. Visit based rewards, spend thresholds, and frequency incentives perform extremely well when delivered through digital loyalty cards.

Better insights without changing the customer experience

Traditional punch cards offer no visibility into performance. Brands are left guessing which offers work and which ones do not.

Digital loyalty cards quietly change that. Digital punch cards track engagement automatically, giving brands insight into visit frequency, reward progress, and redemption behavior. That data helps teams refine programs and improve performance without adding steps for customers.

The experience stays simple. The intelligence happens in the background.

Digital loyalty cards work across industries

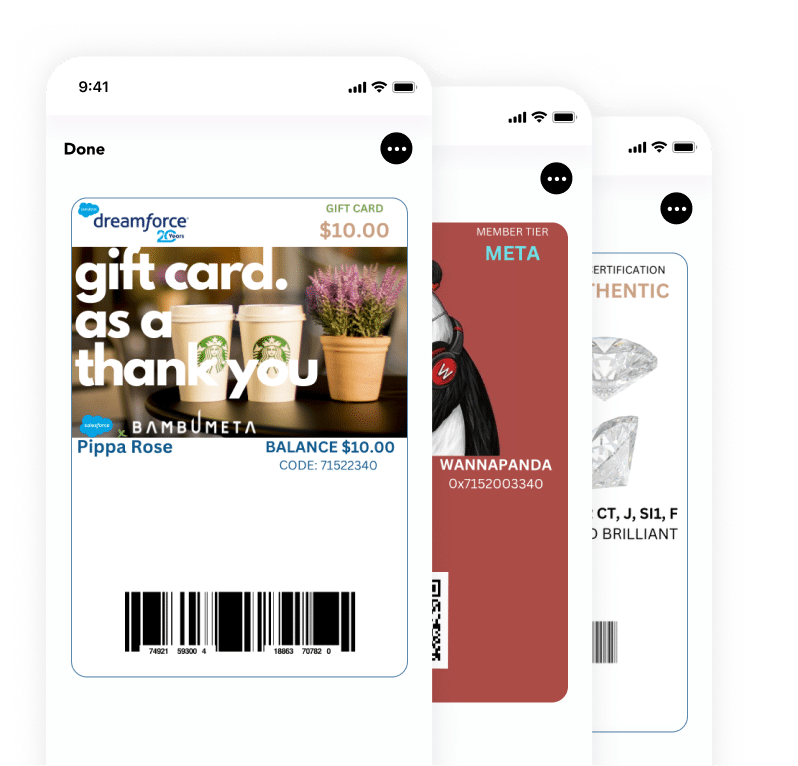

Digital loyalty cards are not tied to one specific type of business. Digital punch cards perform well anywhere repeat behavior matters.

You see them succeed across:

- Coffee shops encouraging routine visits

- QSR brands driving frequency without slowing checkout

- Fitness studios rewarding consistency

- Car washes promoting ongoing usage

- Retailers encouraging return shopping

Because digital loyalty cards scale easily, the same program can support a few locations or hundreds with no change to the customer experience.

Trust, security, and perceived legitimacy

Customers already trust their mobile wallets with important items. Payment methods, boarding passes, and tickets all live there. Digital loyalty cards benefit from that same level of trust.

Digital punch cards feel more official than paper alternatives. They cannot be lost, copied, or damaged. There are no passwords to remember and no accounts to manage. The card is securely tied to the device, which reduces fraud and increases confidence in the program.

That sense of reliability matters more than many brands realize.

Making the move from physical to digital loyalty cards

Transitioning from traditional punch cards to digital loyalty cards does not need to be disruptive. Many brands introduce digital punch cards alongside existing programs and let customers choose.

In most cases, adoption grows naturally through:

- QR codes at checkout

- Simple in store signage

- Brief associate explanations

- Clear messaging around convenience

Once customers experience the ease of digital loyalty cards, paper programs become unnecessary.

The future of digital punch cards

Digital punch cards are not just a replacement for paper cards. They are the foundation for smarter loyalty programs. As mobile wallets continue to evolve, digital loyalty cards will support deeper engagement, better targeting, and more efficient operations.

Brands that adopt digital punch cards now position themselves ahead of competitors still relying on outdated systems. Customers reward convenience, clarity, and consistency.

Digital loyalty cards deliver all three.

If you want a platform that creates and manages digital loyalty cards and digital punch cards for Apple Wallet, Google Wallet, and Samsung Wallet, Bambu Wallet offers one of the most advanced solutions on the market. Find out what is possible in your industry today by booking a demo with the Bambu Wallet team today or connect with us on LinkedIn.