Contactless shopping has shifted from a nice-to-have to a baseline expectation. The pandemic accelerated the move away from touch-based systems, and retailers quickly adapted with tap-to-pay, QR codes, and mobile-friendly solutions. Yet, the story is far from complete. What comes next is a reimagined retail journey where digital wallet passes sit at the center, powering everything from seamless checkouts to self-service experiences and loyalty-driven perks.

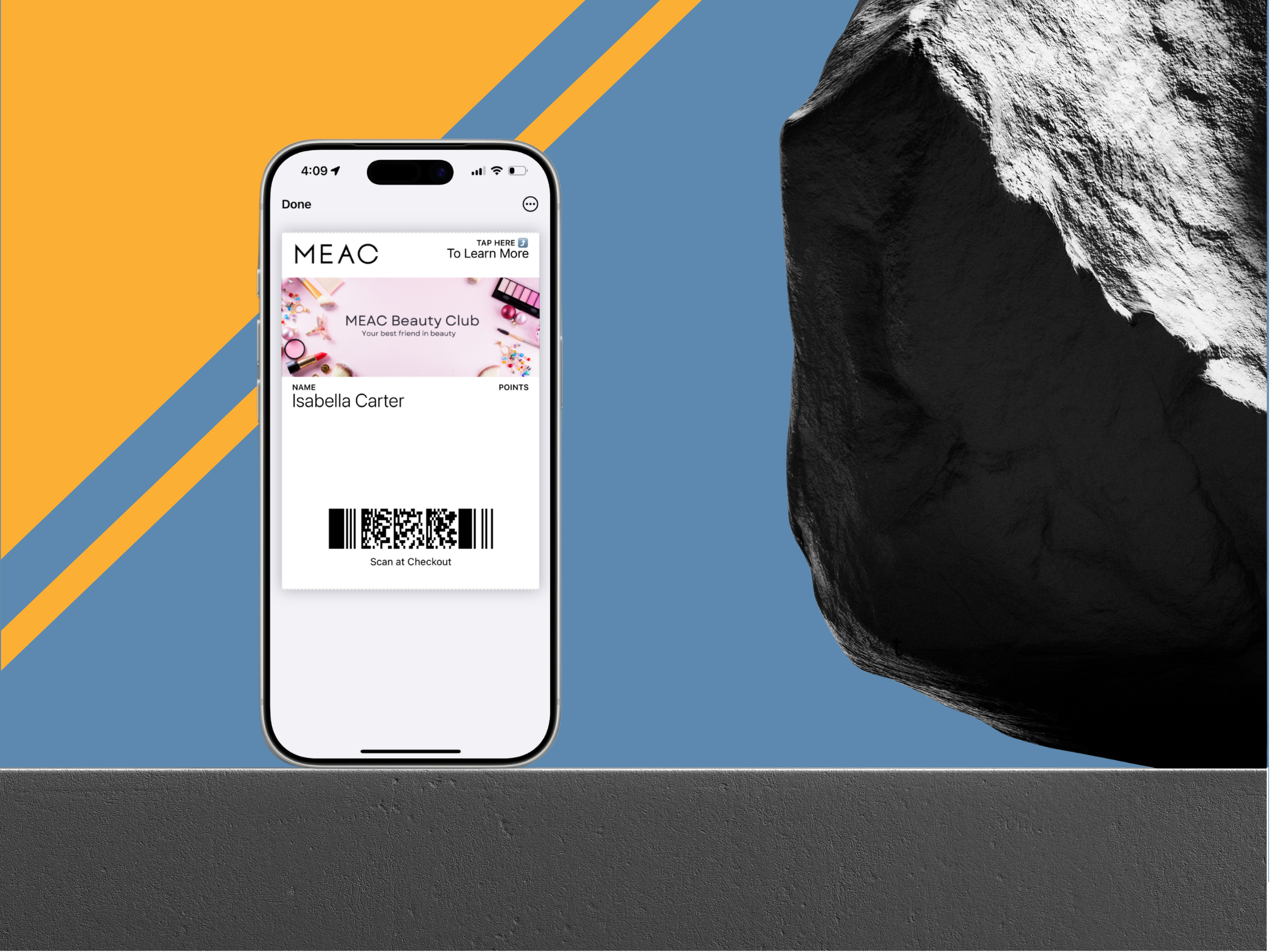

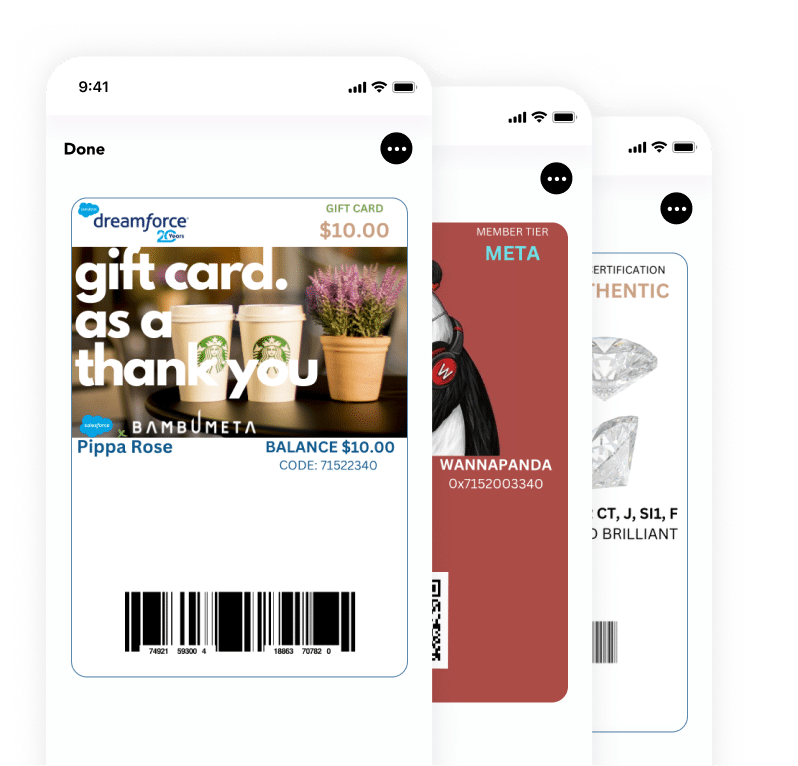

Wallet passes, stored directly in Apple Wallet, Google Wallet, and Samsung Wallet, are evolving beyond coupons or event tickets. They are becoming an all-in-one hub for identification, payment integration, rewards, and personalized offers. Retailers who understand the potential of this shift are building not only faster checkout flows but entirely new kinds of mobile-first experiences.

Frictionless Checkouts

For years, reducing friction at checkout has been the holy grail of retail innovation. Long lines frustrate customers and cost retailers lost sales. Digital wallet passes are tackling this challenge head-on.

Imagine a shopper entering a store where their wallet pass is recognized instantly through geolocation. At checkout, instead of digging for a loyalty card or paper coupon, their phone automatically prompts the right discount and loyalty rewards. If tied to a payment card, the entire process becomes one tap: pay, earn points, redeem discounts, and receive a digital receipt.

What makes this different from basic contactless payments is the deeper integration. Wallet passes can store real-time offers, refresh automatically, and even serve as an entry point into a subscription or membership program. They move beyond payment and become the connective tissue that links the transaction to the broader relationship between customer and brand.

Self-Service and Autonomy

Retail’s future also leans heavily on self-service. From self-checkout kiosks to scan-and-go systems, customers are increasingly comfortable managing their own shopping journeys. Digital wallet passes enhance these systems by giving customers a single, portable tool that covers everything they need.

Think of grocery stores where a shopper’s mobile pass doubles as their loyalty ID, coupon book, and payment option. The customer scans items, taps their wallet pass, and walks out with no waiting and no hassle.

For retailers, this is not just about efficiency. Self-service powered by wallet passes reduces staffing pressure, lowers operational costs, and boosts customer satisfaction by delivering faster, smoother interactions. It is a win-win where shoppers feel empowered and businesses gain streamlined operations.

Building Mobile-First Journeys

A retail journey no longer starts at the storefront. Customers interact with brands long before they step inside a location and often long after they leave. Wallet passes extend a brand’s reach into this full customer lifecycle.

A pass added during an online campaign becomes the key that unlocks in-store perks. After the purchase, the same pass updates with loyalty points, personalized offers, or reminders about upcoming sales. Instead of downloading yet another branded app, which most shoppers do not want to do, the customer uses the wallet that is already on their phone.

This shift toward mobile-first retail journeys matters because it keeps engagement alive in moments where it traditionally faded. An abandoned cart, for example, can trigger an offer update in the customer’s wallet. A loyalty milestone can show up as a push notification that drives the next visit. The wallet pass ensures a brand is always just one tap away.

What Wallet Passes Unlock for Retailers

The benefits for retailers go far beyond speed and convenience. Wallet passes introduce new capabilities that were difficult or costly to achieve with traditional tools.

- Personalized Offers: Dynamic updates allow passes to refresh automatically with tailored promotions based on customer behavior.

- Geo-Smart Engagement: Proximity triggers can send notifications when a shopper is near a store, reminding them of active discounts or rewards.

- Unified Loyalty: Instead of juggling separate loyalty cards and apps, the wallet pass brings rewards directly into the native wallet ecosystem.

- Lower Costs: By cutting down on plastic cards, paper coupons, and app development, wallet passes save retailers significant operational expenses.

- Future-Proof Flexibility: Whether it is coupons, memberships, or even event tickets, passes adapt easily to new retail models.

Rethinking Loyalty in a Contactless World

Loyalty programs often struggle with adoption and engagement. Customers forget their cards, ignore emails, or uninstall apps. Digital wallet passes solve this problem by living in the same space as boarding passes, credit cards, and transit tickets, which are items people use daily.

The result is higher visibility and more frequent engagement. When a loyalty program is built into a wallet pass, customers are reminded of their benefits at every checkout. Offers update automatically and rewards feel instant. That immediacy is powerful. It transforms loyalty from an afterthought into an active driver of repeat visits.

Retailers can go further by using passes to gamify the experience. Milestone notifications, birthday perks, or early access invitations can all appear dynamically within the wallet, creating the sense of exclusivity that keeps customers connected.

The Next Wave: Beyond Payments and Discounts

What comes after loyalty and coupons? The answer lies in expanding what a wallet pass can represent.

Some retailers are experimenting with using passes as digital membership IDs, unlocking perks such as free shipping or VIP lounge access. Others are tying them into event experiences where a pass grants entry to product launches, fashion shows, or exclusive meetups.

The future could also see passes linked directly to product warranties, personalized style recommendations, or sustainability programs. For example, a clothing retailer might push updates to a pass showing care tips for purchased items, recycling options, or resale opportunities. By treating the wallet pass as a living, breathing asset, retailers can maintain a customer relationship long after the initial purchase.

Why This Matters Now

Consumer expectations are evolving quickly. Mobile adoption is nearly universal, and convenience has become the key battleground for retail loyalty. Shoppers are increasingly unwilling to tolerate clunky checkout processes, forgotten rewards, or complicated app ecosystems.

Retailers who adopt wallet passes early will not only reduce friction but also rewire how customers perceive their brand. Instead of being just another store, they become part of a shopper’s everyday digital life. That integration pays dividends in engagement, loyalty, and sales.

Final Thoughts

The future of contactless retail is not about replacing cashiers with kiosks or simply making payments faster. It is about creating seamless, personalized, and mobile-first journeys that customers actually enjoy. Wallet passes are the engine that can power this shift, turning transactions into experiences and loyalty into habit.

Forward-thinking retailers should start small by launching a pass for loyalty, promotions, or memberships. They can then expand into more advanced features like geolocation, dynamic updates, and self-service integrations. The sooner they move, the sooner they will shape the expectations of their customers.

The retailers that thrive in the next era of shopping will not be those with the flashiest apps. They will be the ones who understand that the future is contactless and that digital wallet passes are the bridge to next-generation retail experiences

Ready to see how wallet passes can transform your customer journey? Book a demo with Bambu